Air Products and Chemicals provides industrial gases, related equipment, and applications capability. Co. develops, engineers, builds, owns, and operates industrial gas and carbon-capture projects, supplying hydrogen that will support global transportation, industrial markets, and the broader energy transition away from fossil fuels. Co. engages in hydrogen, helium, and liquefied natural gas process technology and equipment, and provides turbomachinery, membrane systems, and cryogenic containers globally. Co.'s industrial gases business produces and sells atmospheric gases, such as oxygen, nitrogen, and argon; process gases, such as hydrogen, helium, and carbon dioxide; and specialty gases.

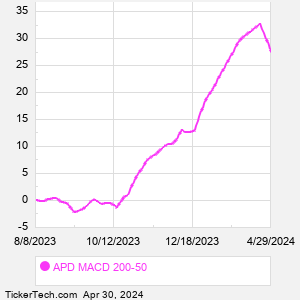

When researching a stock like Air Products and Chemicals, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from APD Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for APD stock — the real life supply and demand for the stock over time — and examines that data in different ways. One of those ways is to calculate a Simpe Moving Average ("SMA") by looking back a certain number of days. One of the most popular "longer look-backs" is the APD 200 day moving average ("APD 200 DMA"), while one of the most popular "shorter look-backs" is the APD 50 day moving average ("APD 50 DMA"). A chart showing both of these popular moving averages is shown on this page for Air Products and Chemicals. |