Invesco is an independent investment management firm. Co. provides a range of active, passive and alternative investment capabilities. Co. has presence in the retail and institutional markets within the investment management industry in North America, Europe, Middle East and Africa and Asia-Pacific. Co.'s asset classes include money market, balanced, equity, fixed income and alternatives. Co.'s distribution channels consist of: Retail, which provides retail products within all of the key asset classes; and Institutional, which provides a suite of domestic and global strategies, including quantitative equities, fixed income, real estate, financial structures and absolute return strategies.

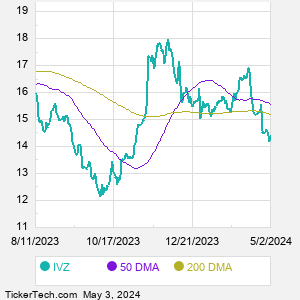

When researching a stock like Invesco, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from IVZ Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for IVZ stock — the real life supply and demand for the stock over time — and examines that data in different ways. One of those ways is to calculate a Simpe Moving Average ("SMA") by looking back a certain number of days. One of the most popular "longer look-backs" is the IVZ 200 day moving average ("IVZ 200 DMA"), while one of the most popular "shorter look-backs" is the IVZ 50 day moving average ("IVZ 50 DMA"). A chart showing both of these popular moving averages is shown on this page for Invesco. |