Visa is engaged in digital payments. Through its network, Co. provides products, solutions and services that facilitate money movement for participants in the ecosystem. Co.'s primary products include: Credit, in which credit cards and digital credentials allow consumers and businesses to access credit to pay for goods and services; Debit, in which debit cards and digital credentials allow consumers and small businesses to purchase goods and services using funds held in their bank accounts; and Prepaid, in which prepaid cards and digital credentials draw from a designated balance funded by individuals, businesses or governments.

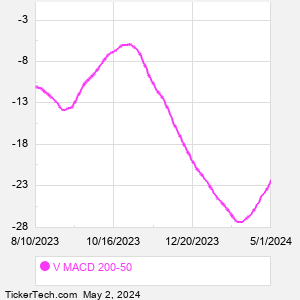

When researching a stock like Visa, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from V Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for V stock — the real life supply and demand for the stock over time — and examines that data in different ways. One of those ways is to calculate a Simpe Moving Average ("SMA") by looking back a certain number of days. One of the most popular "longer look-backs" is the V 200 day moving average ("V 200 DMA"), while one of the most popular "shorter look-backs" is the V 50 day moving average ("V 50 DMA"). A chart showing both of these popular moving averages is shown on this page for Visa. |