Molson Coors Beverage is a holding company. Through its subsidiaries, Co. is a brewer of beverages. From Coors Light, Miller Lite, Molson Canadian, Carling, and Staropramen to Coors Banquet, Blue Moon Belgian White, Blue Moon LightSky, Vizzy, Coors Seltzer, Leinenkugel's Summer Shandy, Creemore Springs, Hop Valley and more, Co. produces various beer brands. Co.'s portfolio includes beer aisle. Co.'s offerings include hard seltzers, ready to drink beverages and a variety of non-alcoholic beverage offerings. Co.'s segments are: Americas, which includes primary breweries, craft breweries and container operations; and EMEA and APAC, which includes primary breweries, craft breweries and cidery.

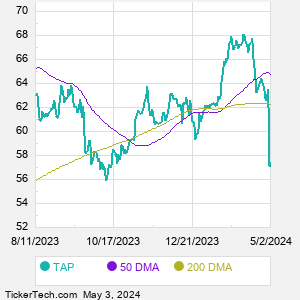

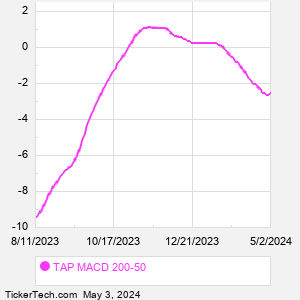

When researching a stock like Molson Coors Brewing, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from TAP Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for TAP stock — the real life supply and demand for the stock over time — and examines that data in different ways. One of those ways is to calculate a Simpe Moving Average ("SMA") by looking back a certain number of days. One of the most popular "longer look-backs" is the TAP 200 day moving average ("TAP 200 DMA"), while one of the most popular "shorter look-backs" is the TAP 50 day moving average ("TAP 50 DMA"). A chart showing both of these popular moving averages is shown on this page for Molson Coors Brewing. |