Fox is a news, sports, and entertainment company. Co.'s segments are: Cable Network Programming, which produces and licenses news and sports content distributed through cable television systems, direct broadcast satellite operators and telecommunication companies, virtual multi-channel video programming distributors and other digital platforms; Television, which produces, acquires, markets and distributes programming through the FOX broadcast network, advertising-supported video-on-demand service Tubi, broadcast television stations, and other digital platforms; and Other, Corporate and Eliminations, which consists of the FOX Studio Lot that provides television and film production services.

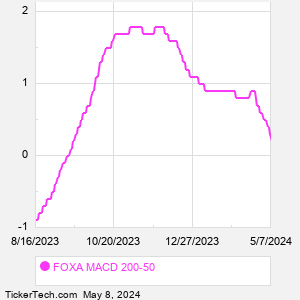

When researching a stock like Fox, many investors are the most familiar with Fundamental Analysis — looking at a company's balance sheet, earnings, revenues, and what's happening in that company's underlying business. Investors who use Fundamental Analysis to identify good stocks to buy or sell can also benefit from FOXA Technical Analysis to help find a good entry or exit point. Technical Analysis is blind to the fundamentals and looks only at the trading data for FOXA stock — the real life supply and demand for the stock over time — and examines that data in different ways. One of those ways is to calculate a Simpe Moving Average ("SMA") by looking back a certain number of days. One of the most popular "longer look-backs" is the FOXA 200 day moving average ("FOXA 200 DMA"), while one of the most popular "shorter look-backs" is the FOXA 50 day moving average ("FOXA 50 DMA"). A chart showing both of these popular moving averages is shown on this page for Fox. |